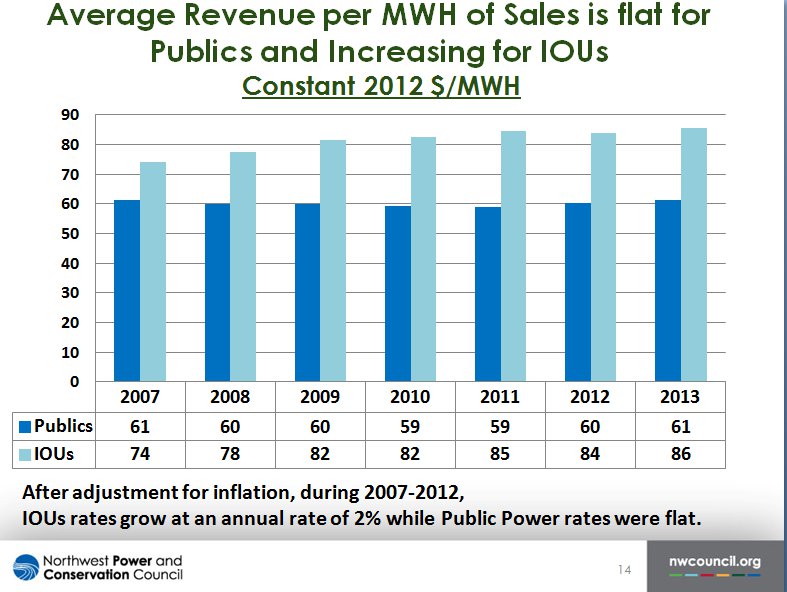

The Growing Disparity in Investor-owned and Public Utilities Rates

Why are investor-owned utility electricity rates rising compared to public-owned utilities? We explain.

- September 25, 2015

- Carol Winkel

As envisioned in the Northwest Power Act, the benefits of the federal power system would be shared by all of the region's consumers, but achieving that vision has proved elusive.

In its analysis for the Seventh Power Plan, which provides guidance to utilities on resources and strategies to ensure the region's power supply, the benefit of using surplus generation for in-region energy and capacity needs was highlighted because it avoids the need to build new resources and lowers total system cost. Under a wide range of future conditions, the least-cost resource strategy depends on the Bonneville Power Administration selling surplus generation in-region.

While by law, regional utilities have first claim to Bonneville's surplus generation, the region's investor-owned utilities ultimately compete with out-of-region buyers for it. And for IOU's, investing in power plants offers the opportunity to increase shareholder value compared to buying power from Bonneville.

Under the current law, IOU access to Bonneville's surplus peaking capacity is limited to seven-year contracts. Without longer term contracts or other contract provisions for energy or capacity, it's likely that new generation will need to be built, despite the availability of energy and capacity resources from Bonneville to serve in-region demand. This will likely continue the trend over the past several years that shows the electricity rates of IOUs increasing while public utility rates have remained flat.